For sustainability leaders in commercial real estate, the challenge isn’t whether to report on ESG metrics; instead, it’s how to do it credibly, consistently, and at scale across diverse portfolios using ESG software..

Investors, lenders, and third-party frameworks like GRESB are no longer satisfied with high-level commitments or static annual reporting. They’re asking harder questions:

- How reliable is the underlying data?

- Is performance improving year over year?

- Can results be independently verified?

This is where building insights and analytics platforms become strategic ESG software infrastructure, not just operational tools.

Reliable Reporting Starts with Portfolio-Grade ESG Software

Many sustainability teams inherit fragmented data environments: utility bills, spreadsheets, bulky automation system exports, and manual estimates stitched together under tight reporting deadlines. This creates risk from reputational and financial standpoints.

Purpose-built ESG software changes the equation by delivering:

- Automated, continuous data collection across energy, water, and indoor environmental quality.

- Standardized metrics aligned with internal benchmarking and external recognition programs, such as GRESB, and their stringent reporting requirements.

- Audit-ready data trails that reduce reliance on estimates and manual entry errors.

For sustainability teams, this means less time chasing data and more confidence that reported metrics stand up to internal governance reviews, investor scrutiny, and third-party validation.

Turning Reporting into Performance

GRESB and similar frameworks reward more than disclosure; they also reward measured year-over-year improvement. Performance scores are driven by complete, portfolio-wide coverage, reductions in energy use and emissions, and demonstrated operational controls.

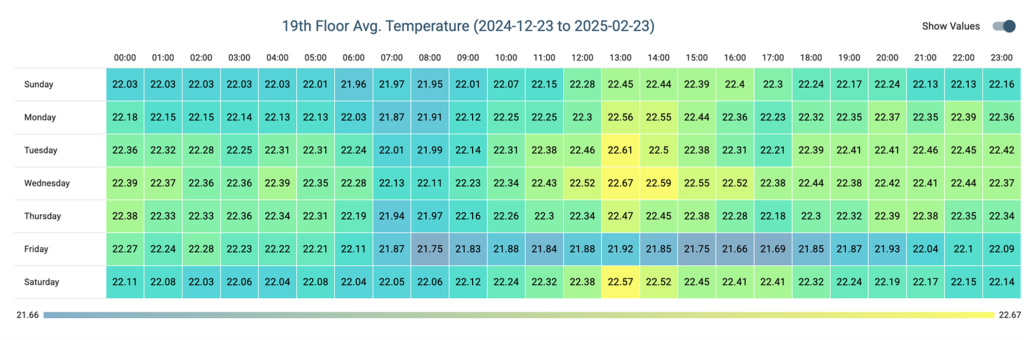

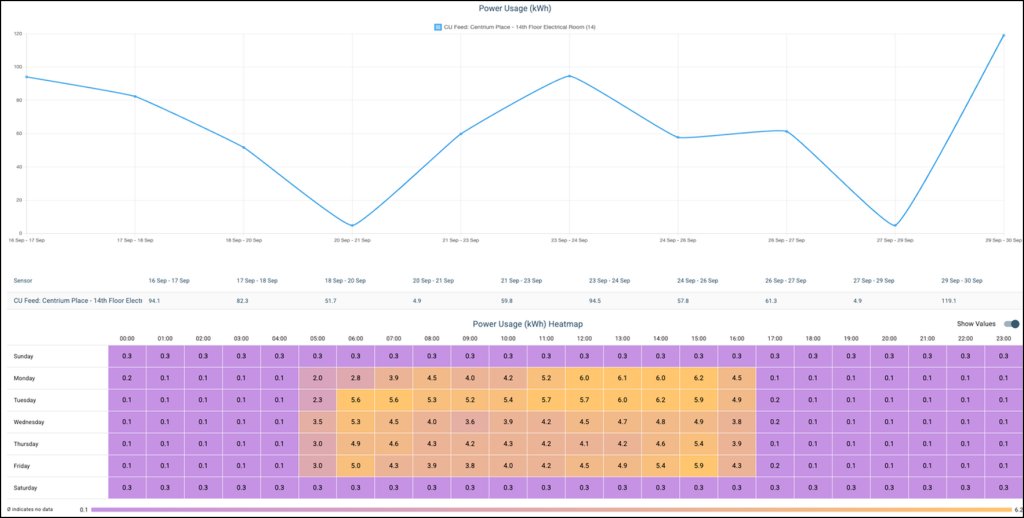

Advanced ESG software enables this by providing real-time visibility into how assets actually perform; not just once a year, but every day. With continuous insights, real estate leaders can:

- Identify underperforming assets early and take corrective action promptly.

- Validate the impact and assess actual results of capital projects and retrofits.

- Collaborate with operations teams using objective, shared data to meet performance improvement objectives.

This shifts sustainability from a reporting exercise to a performance management discipline, directly supporting higher benchmarking scores and stronger peer performance.

Why This Matters Now: Performance Data Is Being Priced Into Deals

With few exceptions, capital markets do not treat sustainability as a side narrative or a “nice to have.” Rather, sustainability principles and outputs are increasingly embedded in underwriting, due diligence, and transaction outcomes for large and small assets alike.

Across acquisitions, refinancings, and dispositions, buyers, lenders, and even insurers are increasingly asking for:

- Verified historical energy and emissions data.

- Evidence of operational controls and monitoring.

- Proof that sustainability and risk prevention claims are measurable and repeatable.

Assets with weak or unverifiable building data face longer diligence timelines, increased underwritten risk, and in some cases, pricing discounts. Conversely, portfolios with a strong ESG software stack are better positioned to accelerate transactions, support sustainability-linked financing, and defend value in uncertain markets.

Building Investor Trust Through Transparency

Capital markets increasingly view building-level data as a proxy for management quality and risk control. Sustainability leaders play a central role in shaping how investors perceive portfolio resilience. When ESG disclosures are backed by real operational analytics, data credibility increases, and investor conversations accelerate from assumptions toward evidence.

What This Looks Like in Practice

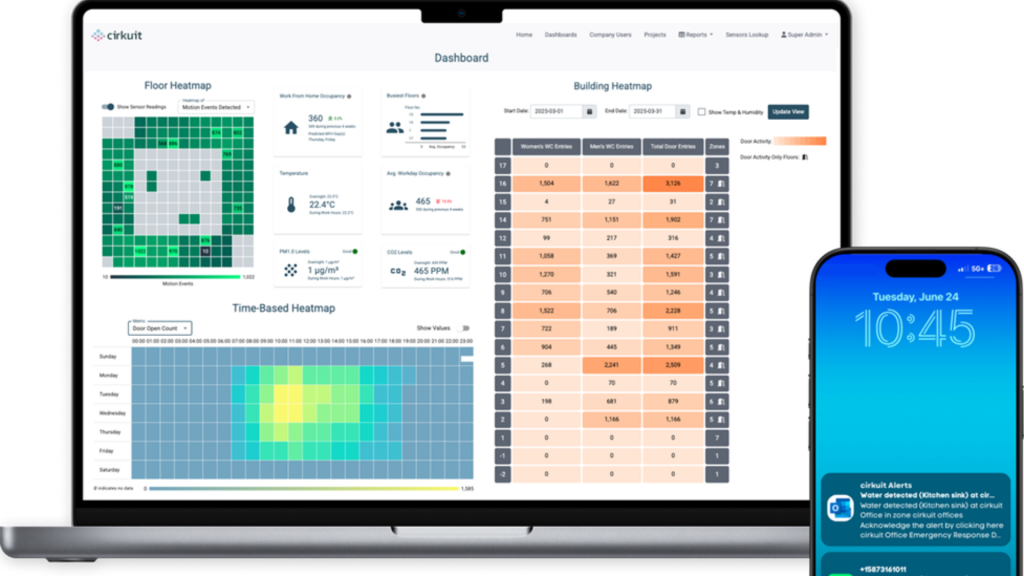

With platforms like cirkuit serving as your core ESG software, sustainability leaders gain:

- Portfolio-wide visibility into real building performance.

- Automated data streams that reduce reporting burden and sync with complementary platforms like ENERGY STAR Portfolio Manager and Angus AnyWhere.

- Actionable insights that connect high-level ESG goals to daily building operations.

For VPs and Directors, clear and articulate building insights is about more than sustainability. This is about protecting asset value and transaction readiness in these unique and uncertain times. Utilizing the right ESG software enables sustainability teams to move upstream, influencing strategy, capital planning, and asset management decisions with absolute credibility.

Take Control of Your Portfolio Performance

Ready to move beyond static reporting and start driving real asset value? Whether you are looking to boost your GRESB scores or secure investor confidence through audit-ready data, cirkuit is here to bridge the gap between building data and boardroom strategy.

Contact the cirkuit team today to see how our platform can transform your sustainability goals into a competitive advantage.